Business Loans for N1 Payments - I

Seeking the following referrals:

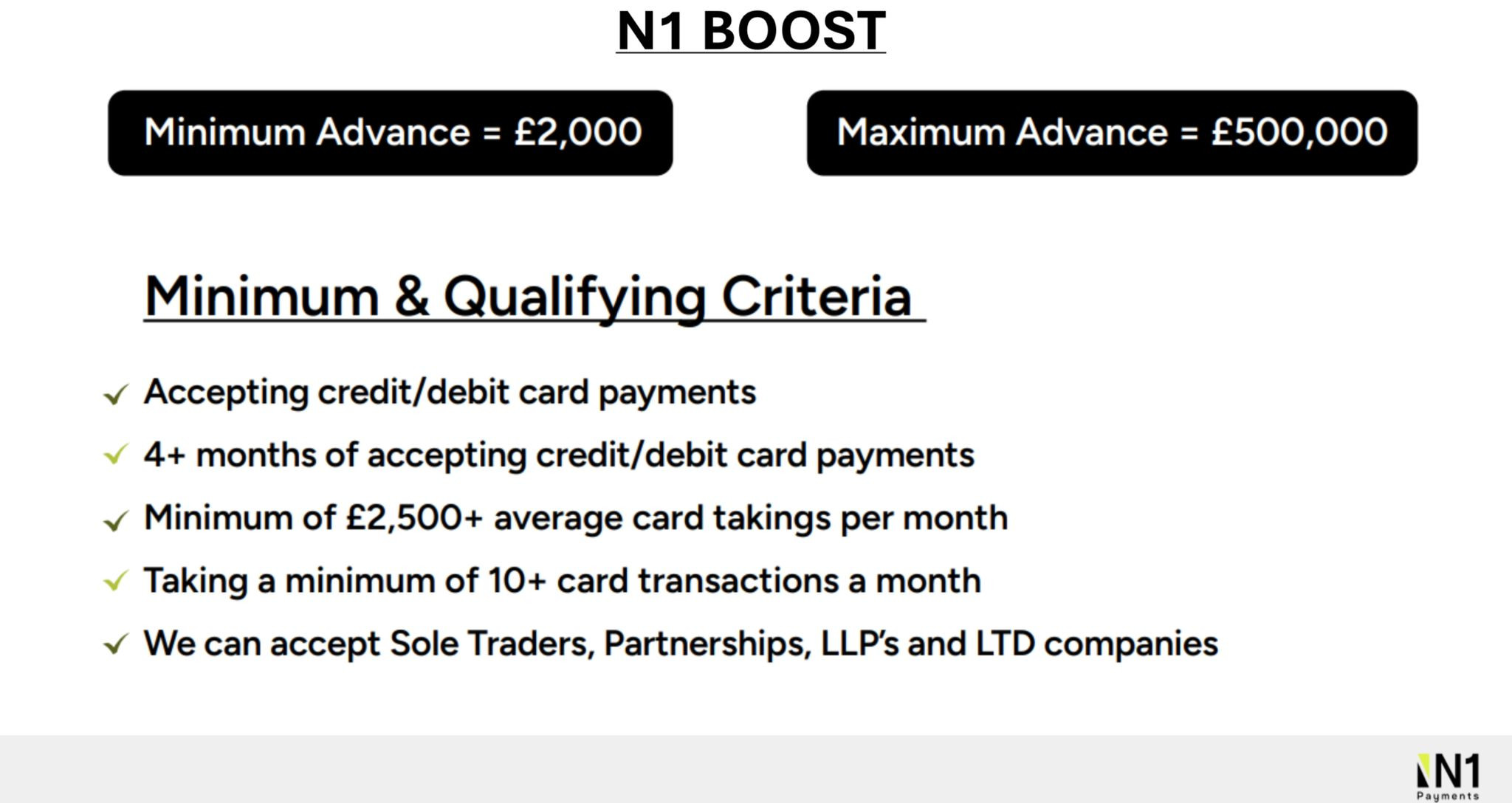

For leads to qualify, they must be accepting credit/debit card payments for a minimum 3 months.

For the following services:

1. Business loans with low percentage APR and repayment plans tailored to your business's card transactions cash flow. 2. Card machines and online payment terminals for businesses, with debit and credit card processing rates starting from 0.9%. 3. EPOS services that integrate all business operations and back-office functions in one place using free software.About this service

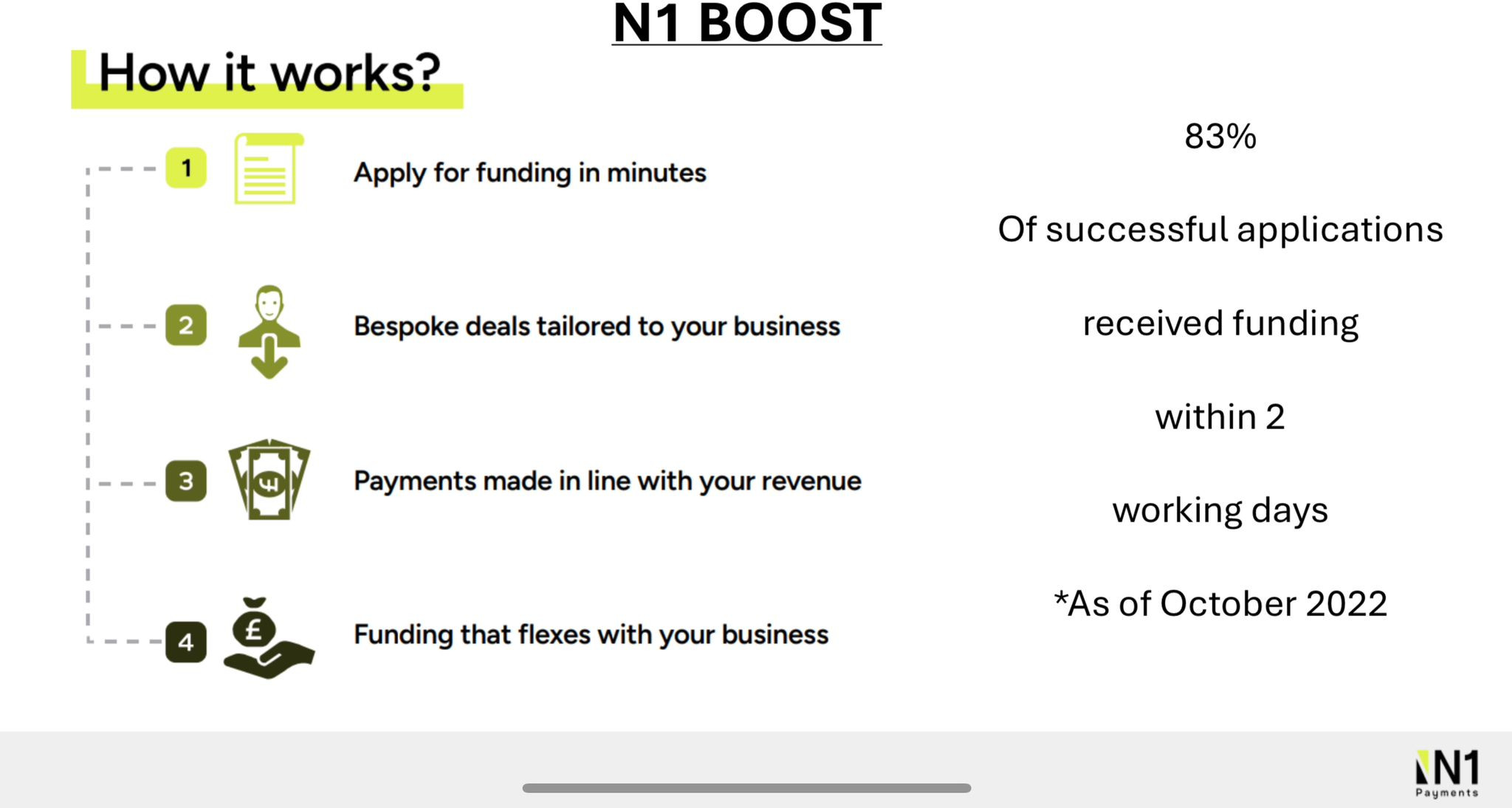

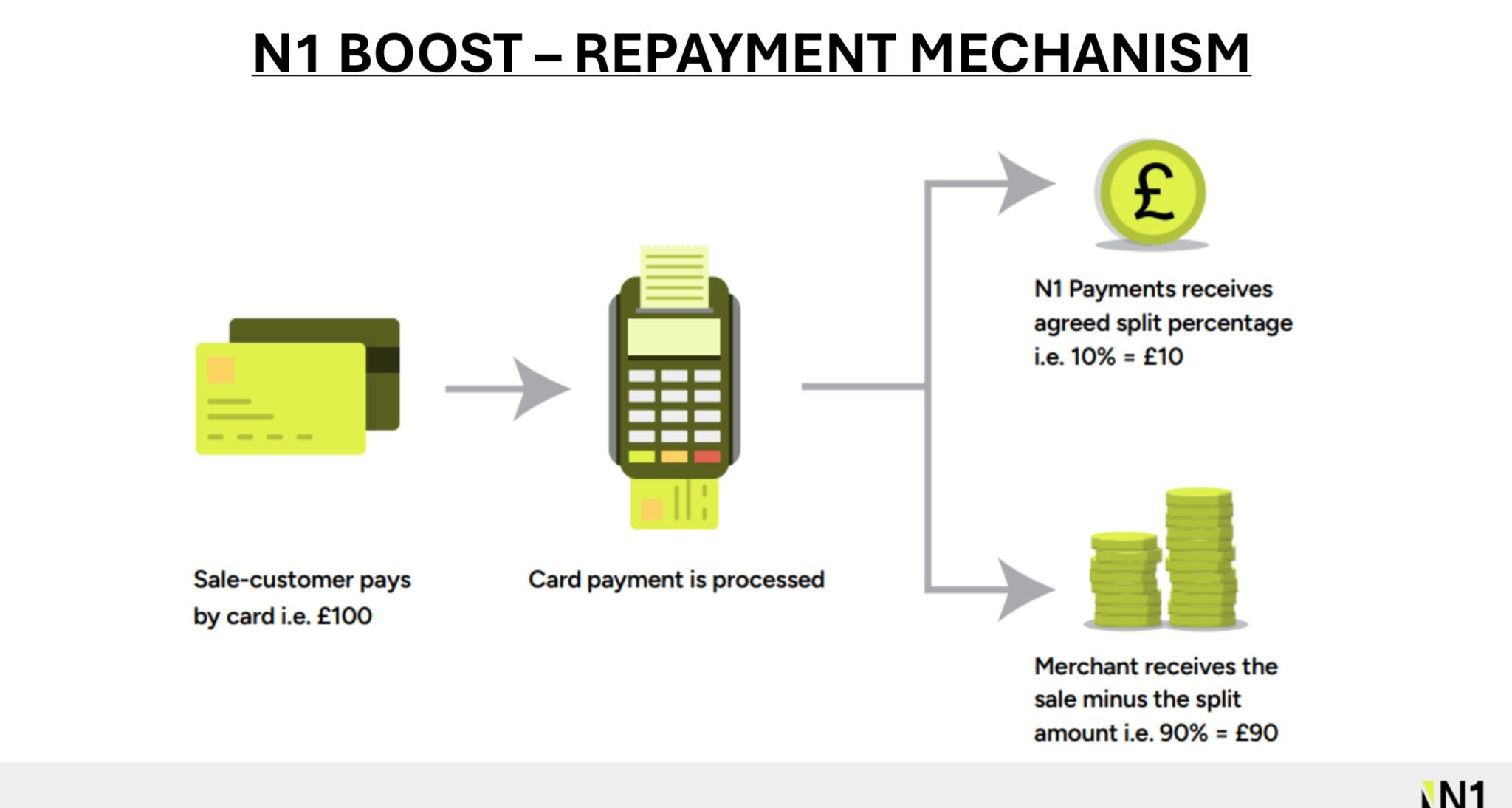

N1 Payments is a dedicated partner in the field of card payments, providing seamless, secure, and cost-effective payment solutions specifically designed for businesses. We serve a wide range of enterprises, from start-ups to large wholesalers, offering competitive rates that meet your needs. Our dedicated support team is available 24/7 to ensure you receive assistance throughout your entire payment process. The processes are split into 2 steps: STEP 1: Getting the Loan: 1. Apply for funding in just minutes. 2. Receive bespoke deals tailored to your business. 3. Enjoy funding that adapts to your business growth. As of October 2022, 83% of successful applications received funding (between £2,000 to £500,000) within two working days. STEP 2: Paying Back the Loan: When a customer completes a purchase during a sale using a credit or debit card, we receive a pre-agreed percentage of the transaction as a split. For example, with a 90/10 split on a £100 transaction, the financial distribution is as follows: - We receive 10% of the transaction value, which amounts to £10. - The merchant keeps the remaining 90%, totalling £90. This is a really good one for businesses because their credit is not affected by taking these loans since there won't be any such thing as "late/missed" payments because when the season is slow/bad, they do not have to make any payments that do not consider their current cash flow. Finally, once 50% of the initially borrowed amount has been repaid, a new loan can be taken out as well. We are looking to engage with qualified business owners and financial decision-makers who have the authority to secure loans or implement structural changes within their organisations. Our approval rate is an impressive 83%, with decisions typically made within two days. Once approved, funds are expected to be deposited into your account by the third day.FAQ

Terms

All referrals must meet the service provider’s terms and conditions as outlined below.

- 4+ months of accepting credit/debit card payments

- Taking a minimum of 10+ card transactions a month

- Minimum of £2,500+ average card takings per month

- The decision maker must be fine with providing a U.K based government ID and 3 month of business bank statements

- The decision maker must be willing to link their business account with N1 payments to facilitate the loan process.